How Series LLCs Benefit Investment Companies

To start an investment company, such as an open-end or closed-end fund, you first need to choose a form of entity. A Delaware Series LLC is often preferred for many reasons.

Why the Delaware Series LLC Is Designed for Investment Companies

The Delaware Series LLC is a good fit for investment companies because it offers flexibility and protection.

Investment companies have engaged in segregating classes of assets into separate funds as far back as the mid 20th century. They first used vehicles known as statutory trusts. For example, high-risk, high-yield investments could be allocated to one trust, and lower performing ten-year notes in another. The trusts issue freely transferable ownership interest to investors. Investors are afforded limited liability proportionate to their investment given they do not participate in management. A group of these funds is effectively known as a “statutory trust series”.

Prior to any supporting legislation, this process was both cumbersome and costly. Despite being part of a single fund family, statutory trusts were treated as being truly separate. Mutual funds were required to complete a costly SEC registration for each statutory trust within the series.

This changed with the Investment Company Act of 1940. The Act legally recognized statutory trust series and enabled companies to maintain separate funds under central management.

The 1990 Delaware Statutory Trust Act further developed the statutory trust series and helped propel the mutual fund industry, enabling the segregation of funds and providing limited liability to investors.

What makes the Delaware Series LLC an evolution of the statutory trust is the addition of legal personhood. At the time, the Delaware Statutory Trust Act did not grant series trusts any of the typical characteristics of legal personhood. For example, trusts did not have the power to sue or be sued, and they could not contract or hold property in their own name. These are all powers that protected series were purpose-built to have. This makes the Delaware Series LLC adaptable for many different business types.

What is a Series LLC?

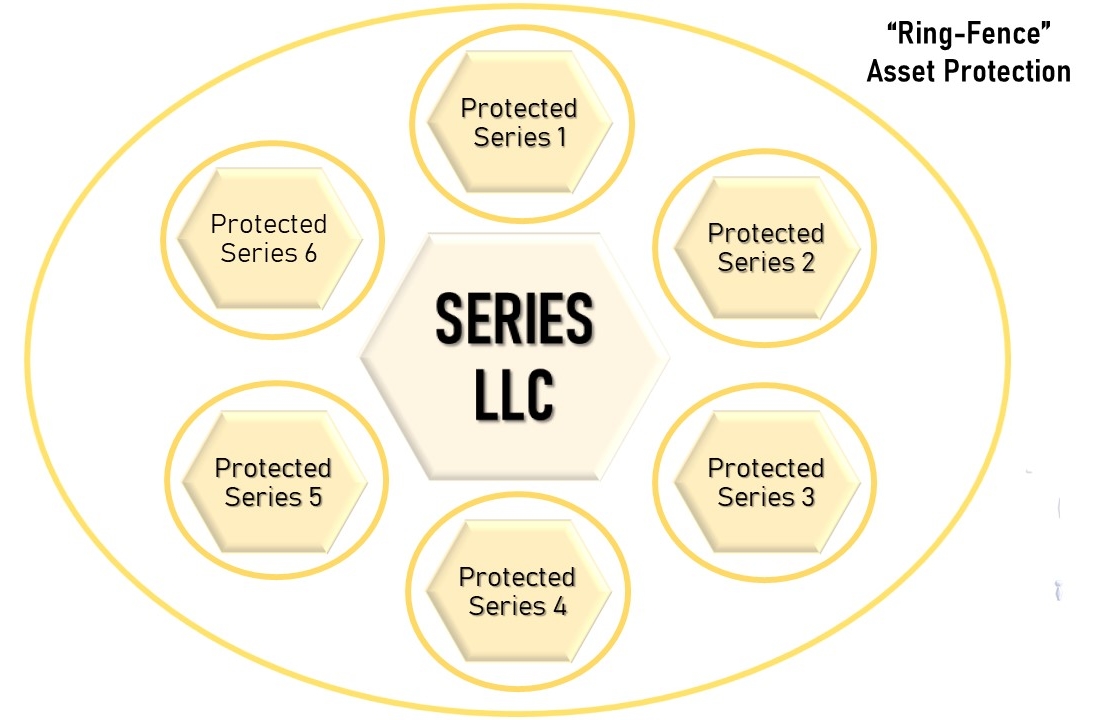

Created by the Delaware General Assembly in 1996, the Series LLC is the next evolution of the ever popular Limited Liability Company. Under a Series LLC, one entity is created by filing a Certificate of Formation with the Delaware Secretary of State. This single LLC has the ability to create an unlimited number of separate cells, known as “protected series”, through its operating agreement. Each protected series can have a separate business purpose, separate associated assets, and even separate members.

Created by the Delaware General Assembly in 1996, the Series LLC is the next evolution of the ever popular Limited Liability Company. Under a Series LLC, one entity is created by filing a Certificate of Formation with the Delaware Secretary of State. This single LLC has the ability to create an unlimited number of separate cells, known as “protected series”, through its operating agreement. Each protected series can have a separate business purpose, separate associated assets, and even separate members.

Assets of each protected series are firewalled off in two directions: vertically, at the company level, and horizontally, between the other protected series. This type of asset protection structure is often labeled “ring-fencing”.

Every protected series associated with a single Delaware Series LLC is considered to be a legal person. As a result, each protected series has many of the same rights and powers of a traditional LLC. A protected series can contract in its own name, own or hold title to assets or property, grant loans, obtain an EIN number, and open a bank account.

“Each protected series can have a separate business purpose, separate associated assets, and even separate members”.

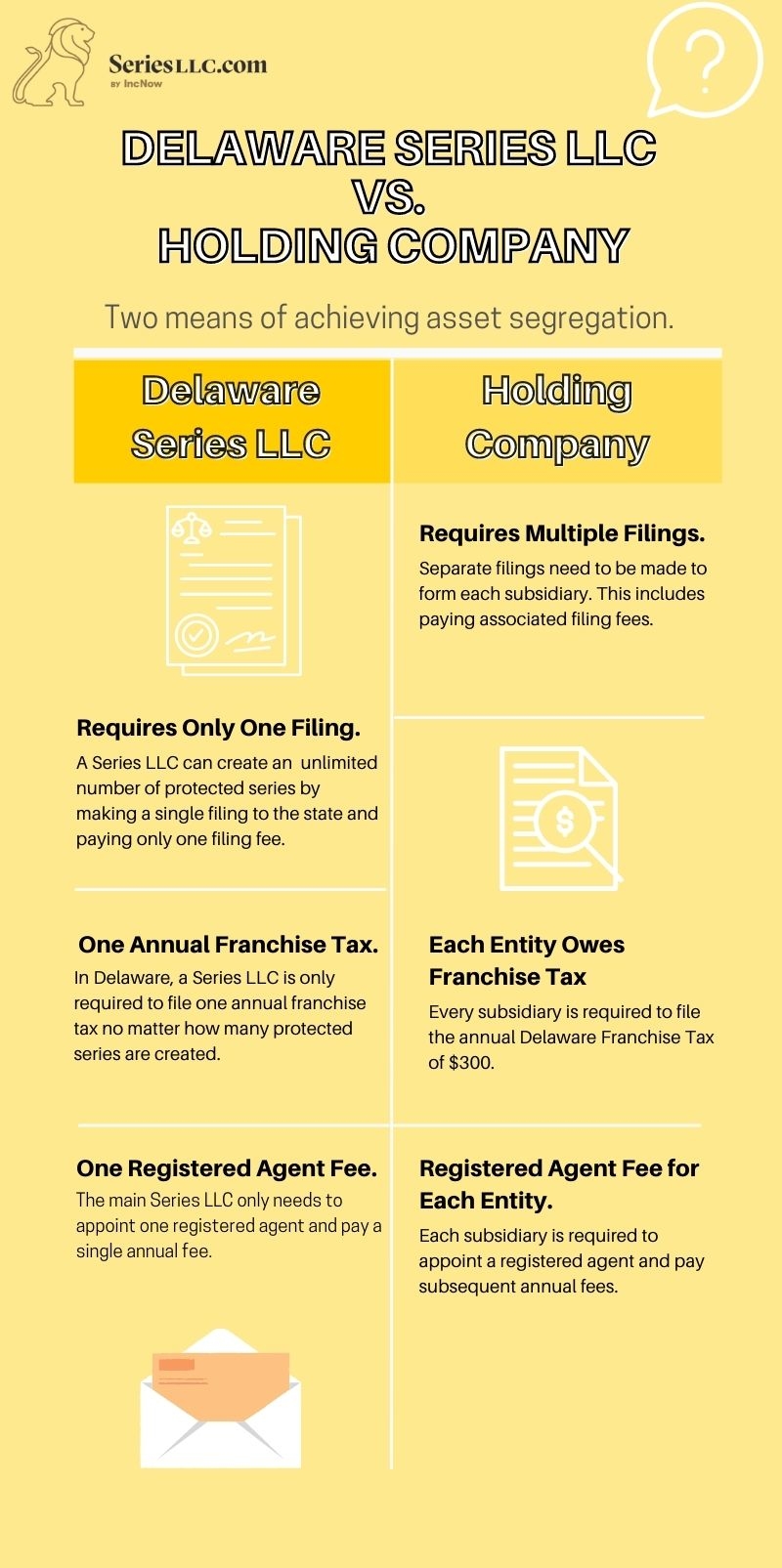

Series LLC vs. a Holding Company

Many investment companies may consider using multiple LLCs to form a holding company structure.

The traditional Delaware LLC is an extremely popular entity structure amongst businesses of all sizes. It is a reliable means of providing limited liability for members and predictable governance for ownership and management.

One way of structuring an organization is to use a Delaware LLC as the single member and manager of a number of operating LLCs also filed in Delaware. Often, this has been accomplished by creating separate LLCs, known as subsidiaries, for different lines of business or separate business assets. The main entity is referred to as a holding company. The holding company is named as the member of each subsidiary LLC and is issued all of the membership interest. This results in an ecosystem where multiple businesses are connected, however, their individual debts, liabilities, and obligations are separate from one another.

How Does the Series LLC Improve Upon the Holding Company?

The holding company structure is sound in providing limited liability between business assets. However, there are drawbacks, mainly in the form of administrative burdens and costs. Micro-entrepreneurs and solo-entrepreneurs are burdened with the time and monetary costs of forming multiple entities and maintaining each entity’s associated filing fees. Each LLC has an annual franchise tax and a duty to maintain a Registered Agent in the state of formation.

The Delaware Series LLC came along in 1996 as special interest legislation for the mutual fund and regulated finance industries. This was a benefit because multiple classes of funds only needed one SEC filing. In Delaware, a Series LLC with protected series only pays one annual franchise tax and only needs to pay a single Registered Agent fee. This has made the Series LLC popular among small time “serial entrepreneurs” looking to incubate many business ideas simultaneously to see which will thrive.

The Delaware Series LLC enables founders to create unique and innovative ownership structures through the Operating Agreement. These structures can include different classes of members with differing rights, responsibilities, and voting capacities. For example, this allows investor A to be a member associated with the assets of protected series 1 only. Then investor B can be a member associated with the assets of protected series 2 only, and so on.

“The Delaware Series LLC came along in 1996 as special interest legislation for the mutual fund and regulated finance industries”.

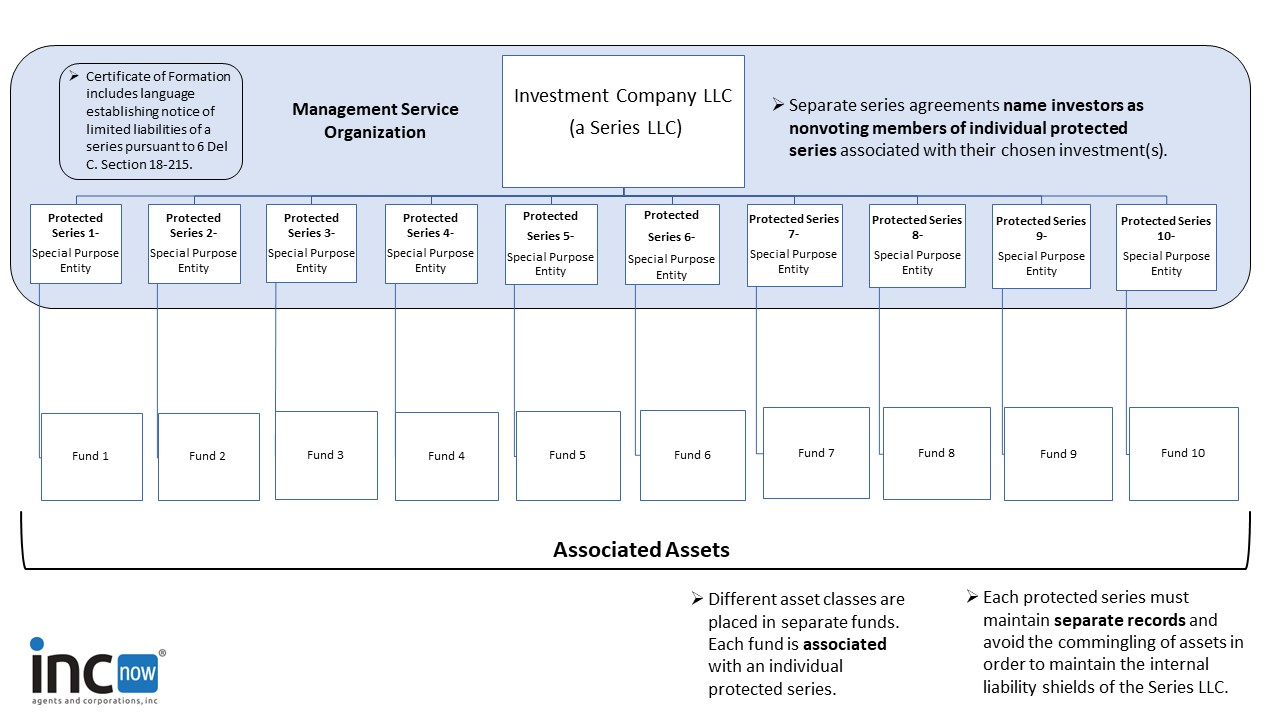

How Do You Structure an Investment Company as a Series LLC?

Here is an example of how an investment company operating as a closed-end fund can be formed as a Series LLC:

Under this structure, the company itself serves as the “management service organization”, or MSO. The express purpose of the MSO is to manage the funds held by each protected series.

Each protected series is set up as a special purpose entity created to hold individual associated assets. An investment company can isolate financial risk utilizing the internal firewalls in place between each protected series. This can keep one particular asset from becoming a contagion that infects the entire fund family.

With the creation of each protected series, separate series agreements would be drafted to name individual investors as non voting members of the protected series associated with their chosen investment(s).

When an investment reaches maturity, the protected series could be terminated and its assets liquidated. Distributions can be made to investors proportionate to their share outlined in the separate series agreements.

“An investment company can isolate financial risk utilizing the internal firewalls in place between each protected series”.

How Do I Start a Delaware Series LLC?

Creating a Delaware Series LLC starts with filing a Certificate of Formation with the Delaware Secretary of State. The Certificate of Formation requires little information about the company, other than its name. It does not need to include the names of the members.

It is important that the Certificate contains specific language citing Delaware Code Chapter 18 Section 215. This establishes notice of the limited liabilities of a series, which is a prerequisite for the internal liability shields to be honored in court.

A Delaware Series LLC only needs to appoint one registered agent no matter how many protected series it creates. The name of the registered agent is also included in the Certificate of Formation.

The next step is to draft the Series LLC Operating Agreement. This is an internal document that will serve as the foundation of your Series LLC. This internal document governs how ownership and responsibilities will be managed throughout the life of the company. In the event of a disagreement amongst LLC members, the operating agreement serves as the guide for resolving disputes in a swift and just manner. Additionally, Separate Series Agreements must be drafted to establish each protected series.

Every entity must maintain a physical address in the state of Delaware in order to receive legal notices, such as lawsuits. To comply with this provision, you must appoint a registered agent. A registered agent operates an office in Delaware and is responsible for receiving “service of process” on behalf of your company.

Consult with an Attorney

The investment fund industry is well regulated, and you should engage an experienced securities attorney to assist you with the process. Almost all securities attorneys will be familiar with the Delaware Series LLC as a tool to help you accomplish your goals efficiently under one entity umbrella that is purpose built for this application.