What Is A Registered Series And How Is It Different?

In 2019, the Delaware General Assembly adopted amendments to the state’s Series LLC law allowing for the creation of “registered series”. A Delaware Series LLC is able to establish both registered series and protected series concomitantly. One entity umbrella can house an unlimited number of each series type.

The Delaware Registered Series is a giant improvement. The new amendments make the Series LLC a more capable entity with the potential to better benefit ambitious entrepreneurs.

What is a Delaware Registered Series exactly? We cover the details of registered series and how they can benefit your business.

What Is A Series LLC?

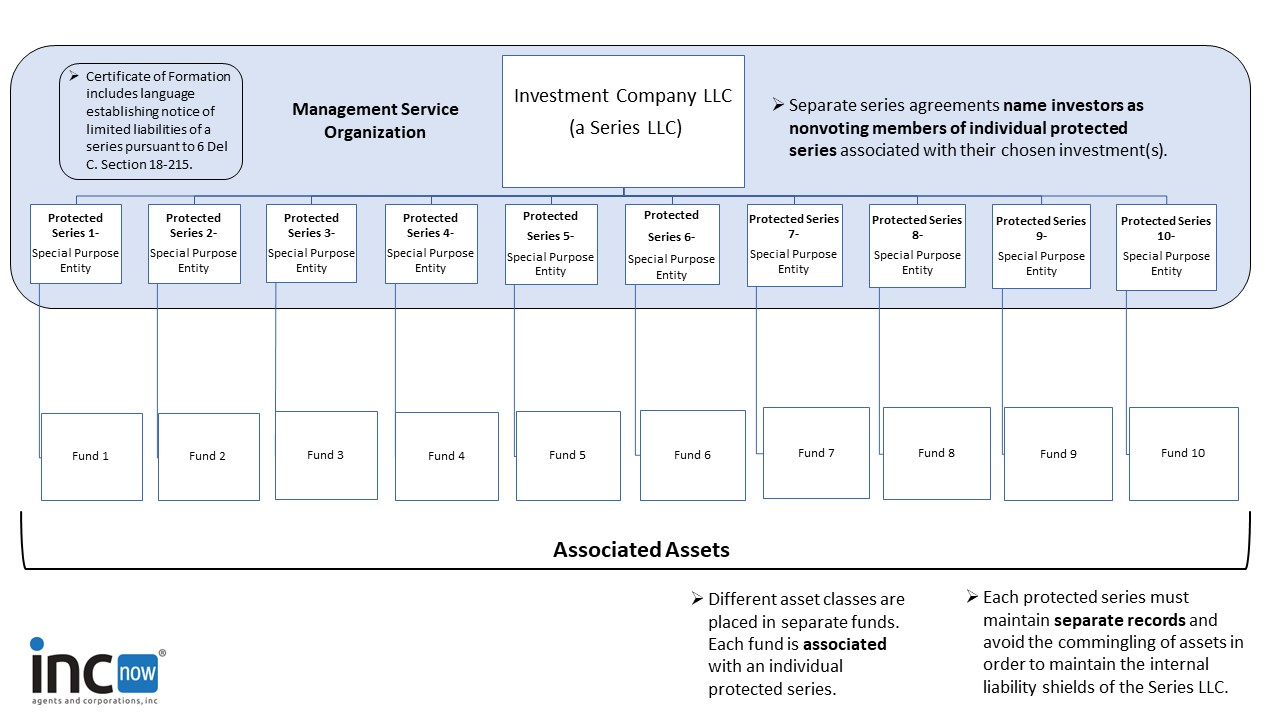

In 1996, Delaware amended its LLC Act to give LLCs the power to create an unlimited number of cells separate from the main LLC. These would later be known as “protected series”.

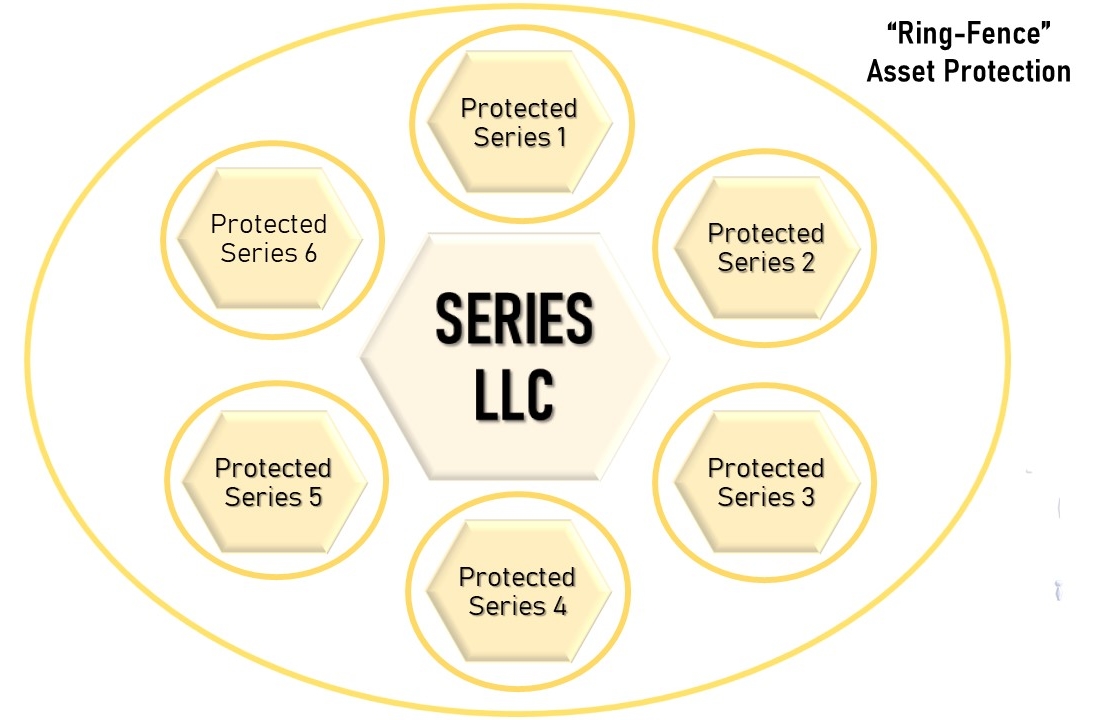

Each protected series can have a separate business purpose, separate associated assets and even separate members. These protections are contingent on the company’s Certificate of Formation and Operating Agreement which must containing proper language for establishing the limited liability of a series.

“Pursuant to the Delaware LLC Act § 18-215 (b), the “debts, liabilities, obligations, and expenses” of each series are enforceable against the assets of that series only. The assets of each protected series are effectively off limits to creditors of any other protected series or the company.”

Forming a Delaware Series LLC requires filing only one Certificate of Formation with the Secretary of State. A Delaware Series LLC can freely create protected series through its private Operating Agreement without making any additional filings or paying additional state fees.

What Is A Registered Series?

Registered series function similarly to protected series, however, they have unique legal characteristics. A registered series benefits from being recognized as a “registered organization” under Article 9 of the Uniform Commercial Code. This gives a registered series the right to pledge its associated assets separately from the main LLC in secured financing transactions.

Serial entrepreneurs who operate multiple businesses often anticipate that one product may take off while others lag behind or experience set-backs. The Series LLC enables these entrepreneurs to separate and protect multiple businesses or product lines during an initial incubation period. With a registered series, it is possible to spin-off a successful product into a separate LLC. This provides entrepreneurs with even more freedom and flexibility to test various business types and explore opportunities. A registered series is like a baby bird that can then leave the nest, spreading its wings to fly on its own.

How To Form A Delaware Registered Series.

A Delaware Registered Series is established by completing three steps:

1.) Form a Delaware Series LLC.

First, a Delaware Series LLC is formed by filing a Certificate of Formation with the Delaware Secretary of State.

Note: The Certificate of Formation must include specific language providing for the limited liability of a series.

2.) List Registered Series In The Series LLC Operating Agreement.

Next, registered series are established in the Series LLC’s private Operating Agreement.

3.) File A Certificate of Registered Series

Finally, a Certificate of Registered Series is filed with the Delaware Secretary of State. The Certificate includes both the name of the Series LLC (company) and the newly created registered series.

Naming Conventions for Registered Series

The Delaware LLC Act requires that specific conventions be followed for naming a registered series. The name of a registered series must begin with the name of the LLC followed by the name of the series.

In general, the name of a registered series must be distinguishable from that of any other series or qualified business entity existing in the state record.

How Is A Registered Series Different?

Registered series differs from the original “protected series” in several ways.

In addition to being established through the Operating Agreement, creating a registered series requires a separate public filing . This amendment was inspired by the Illinois Series LLC statute which requires each protected series to file a Certificate of Designation.

The addition of registered series language to the DE LLC Act increases the utility of the Delaware Series LLC. A registered series is able to obtain a Certificate of Good Standing from the Delaware Secretary of State. This Certificate states that an organization has paid its franchise tax within its state of formation. A Certificate of Good Standing has many important uses. For example, a bank may require a Certificate of Good Standing in order to open a business bank account, or obtain certain business loans.

A registered series qualifies as a “registered organization”. This allows lenders to perfect security interest in assets of that registered series which are pledged as collateral for credit. This is achieved by filing a UCC-1 Financing Statement.

Converting A Protected Series To A Registered Series.

The Delaware Series LLC statute allows a protected series to be converted to a registered series, and vice versa.

The following steps are required to convert a protected series to a registered series:

1.) Members Vote On The Conversion

First, the conversion must be approved by any associated members of the series with voting privileges.

2.) File A Certificate of Conversion

After gaining approval from members, a Certificate of Conversion must be filed with the Delaware Secretary of State.

3.) File The Certificate of Registered Series

Next, a Certificate of Registered Series must be filed with the state.

4.) List Registered Series In The Operating Agreement

Finally, the Operating Agreement must be amended to include the new registered series.

Converting a registered series to a protected series is done through a similar process:

1.) Members Vote On The Conversion

Associated members must vote to approve the conversion.

2.) File A Certificate of Conversion

Then, a Certificate of Conversion must be filed with the Secretary of State.

3.) Amend The Operating Agreement

The Series LLC Operating Agreement should be amended to ensure that the status of the series is accurate in all internal documents.

How Much Does a Delaware Registered Series Cost?

Creating a Delaware Registered Series involves additional costs compared to the protected series. Here is a break down of the initial start-up and maintenance costs for a registered series:

1.) Filing Fees

There is a $90 filing fee associated with each registered series.

2.) Annual Fees

Additionally, there is an annual fee of $75 to maintain each registered series and keep it in Good Standing.

The company as a whole is required to pay one Delaware Annual Franchise Tax of $300. This is due on June 1 of each year after formation.

A Series LLC with multiple registered series must maintain a Registered Agent for each registered series. This could result in additional Registered Agent fees.

Comparing Costs: Protected Series vs. Registered Series

There are no additional state fees associated with forming or maintaining any number of protected series. A Delaware Series LLC can freely create and dissolve an unlimited number of protected series without making any additional filings. A protected series is also not required to pay any annual fees.

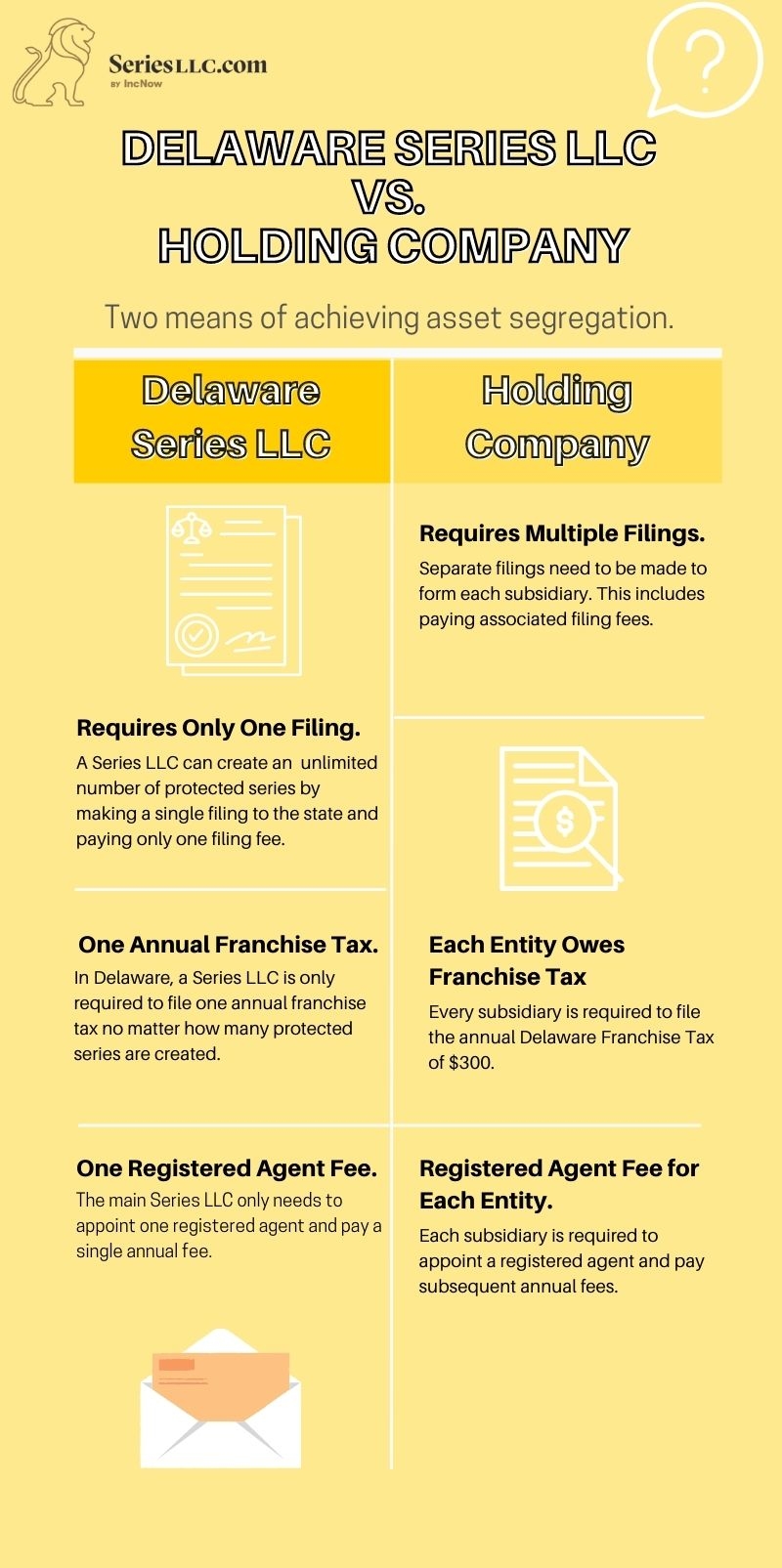

Even with additional filing fees, operating registered series can still be more cost effective than traditional asset protection strategies, like using holding companies. Creating a holding company involves forming several subsidiary LLCs. Each LLC is an individual operating business with separate assets.

Forming a holding company requires paying filing fees to set up each entity. Additionally, each subsidiary LLC would need to pay Delaware Annual Franchise Tax in addition to an annual fee to maintain its own Registered Agent.

Who Is A Registered Series For?

The registered series may be better suited for companies requiring secured capital financing. One of the primary benefits of a registered series is the ability to perfect security interests in assets through a UCC financing statement. Choosing a registered series over a protected series can be beneficial to bigger companies with larger balance sheets.

Why a Registered Series?

The motivation behind the registered series stems from discrepancies between the original Delaware Series LLC statute and the Uniform Commercial Code (“UCC”).

When seeking out credit, debtors often want to avoid over collateralizing a loan with unrelated assets. This means they want to limit a secured creditor to perfect their interest in the assets pledged by the borrower’s registered series and not any other company assets. This can be achieved by filing a Delaware UCC-1 Financing Statement listing one registered series as debtor. Properly filing the UCC-1 allows the lender to provide public notice of their interest in the asset and gives them security over these assets in the event of a dispute.

Language in the Article 9 secured transactions does not allow a protected series to separately qualify as a “debtor” on any credit extended to it. Instead, the debtor is the entire LLC.

Further questions concern the location of the organization as a debtor. According to the UCC, a financing statement filed on behalf of a debtor which is a registered organization is filed in the state where the entity is organized. Therefore, a registered series filed in Delaware means the UCC-1 would be filed in Delaware

The Registered Series Amendment is A Step Forward.

Clarification about how the Delaware Series LLC interacts with the UCC will encourage further adoption of the Series LLC by other states. This in-turn will further grow the entity’s popularity with entrepreneurs and business owners.

Other states have already begun adopting the registered series since its introduction by Delaware in 2019. On June 1, 2022, Texas amended its own Series LLC allowing for a Series LLC to have both protected and registered series. These entities are often used in oil exploration financing.

Work has been done outside of Delaware law to progress the adoption of Series LLC legislation in other states. In 2017, the Uniform Law Commission (“ULC”) published the Uniform Protected Series Act (“UPSA”). The UPSA creates prescriptive rules aimed at ensuring that Series LLCs are used responsibly.

The fact that the Delaware General Assembly continues to revise their Series LLC law demonstrates the legislature’s commitment to the continued success of Series LLCs. Delaware has shown that it is willing to continue refining its laws to support the world’s most ambitious entrepreneurs and innovators by enabling them to profit from this powerful and innovative entity.

[/av_textblock]

Created by the Delaware General Assembly in 1996, the

Created by the Delaware General Assembly in 1996, the