Grow Your Business With a Series LLC

According to the Bureau of Labor Statistics, 20% of businesses fail in their first year, and only 50% will make it to their fifth year. One of the main reasons businesses fail is inflexibility. You often find inflexibility in a company’s business plan, however, it can also show up in its legal structure.

More traditional entity types, like LLCs, are not dynamic and can add friction when a company is trying to grow and expand. Successful business owners have used Delaware Series LLCs to get past this. Serial entrepreneurs are using Delaware Series LLCs as a growth hack to protect their personal assets while quickly scaling their business ideas.

The Delaware Series LLC Business Growth Hack

Forming a Delaware Series LLC can enable entrepreneurs looking to explore several business ideas in hopes of finding out what works. Here is how to use a Delaware Series LLC to accelerate business growth.

Step 1.) Protect Multiple Businesses With One Entity

A Series LLC enables entrepreneurs to incubate different ideas or products while protecting both themselves and the business as a whole.

An entrepreneur can put different businesses into individual protected series. This keeps the assets and liabilities of each business separate from one another. If one business experience’s setbacks, or even fails, the creditors of that business cannot come after the assets of related businesses or the Series LLC in general.

Additionally, business owners also receive these protections for their personal assets. This offers entrepreneurs the freedom to put ambitious thoughts into action.

Step 2.) Spin Off Successful Businesses

Entrepreneurs trying several ideas and gaining experience are bound to find a business that takes off. Series LLC owners can spin off successful businesses held within protected series as separate LLCs.

By incubating business ideas and spinning off winners, entrepreneurs can substantially reduce their personal liability risk while achieving significant business benefits.

What Is a Series LLC?

Most entrepreneurs are familiar with the traditional Limited Liability Company, or LLC. The LLC has become the most popular entity type for small businesses. This is because LLCs are easy to set up and relatively cheap to maintain.

The Series LLC is the next evolution of the LLC. Created by Delaware in 1996, the Series LLC allows companies to provide limited liability protection for multiple businesses using just one entity.

A Series LLC has the ability to create an unlimited number of separate units called “protected series”. Each protected series can have a separate business purpose, separate business assets and even separate members or managers.

Delaware Series LLC vs. LLC

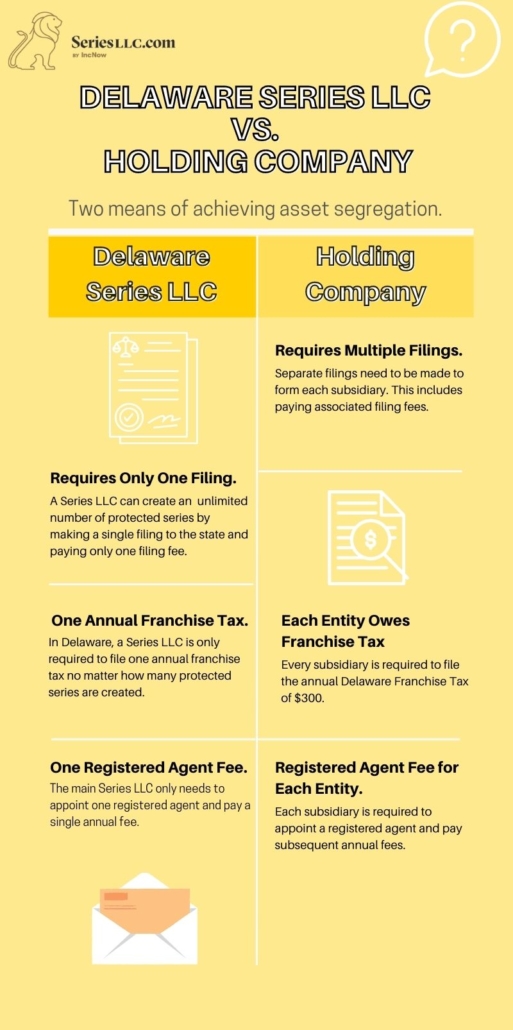

Before the Series LLC, entrepreneurs had to endure a more costly and inefficient process to protect multiple businesses from cross liability. Business owners traditionally form each new business as a separate LLC; each of which is owned by a Holding Company. Forming each LLC requires filing a Certificate of Formation, paying associated filing fees, and paying Annual Franchise Tax.

The Delaware Series LLC is great for serial entrepreneurs because it is completely flexible. The Series LLC enables entrepreneurs to create unique ownership structures that are tailored for the specific needs of their business. A Delaware Series LLC can also be more cost effective to maintain. Creating a Delaware Series LLC requires making only one filing and paying one Annual Franchise Tax for the whole entity.

Delaware Series LLC Business Benefits

In addition to asset protection, the Delaware Series LLC offers several key business benefits. These benefits include:

- Reduced Costs

Forming a Delaware Series LLC requires paying only one filing fee. Additionally, a Delaware Series LLC only needs to make one Annual Franchise Tax payment no matter how many protected series it creates.

- Flexibility

The Series LLC offers flexibility through its Operating Agreement. The Operating Agreement is a private document that governs the internal affairs of a Series LLC.

The Operating Agreement allows Series LLC members to tailor a legal structure that meets the needs of their business. Members can create unique ownership structures, establish special provisions like a Right of First Refusal, and make personalized schedules for distributing profits.

Series LLC owners can easily adjust the company’s legal structure as it grows by amending the Operating Agreement. Since the Operating Agreement is a private contract, Series LLC members can make changes to the ownership structure without having to file any documents with the state.

- Administrative Efficiency

Series LLC owners create new protected series simply by adding them in the Operating Agreement. No additional state filings are necessary after forming a Series LLC.

- Consolidated Ownership

Members in a Series LLC can be associated with each protected series. Serial entrepreneurs can centralize decisions across multiple businesses. This enables ease of management.

How Do Series LLCs Work, Exactly?

Protected series of a Series LLC have their own asset shields, just like a traditional LLC. A Series LLC protects the business assets of each protected series from the liabilities of the other businesses. This means you can manage multiple businesses under one entity while keeping their individual assets and liabilities separate.

This asset protection strategy is called “ring fencing”. Think of a Series LLC like horses in a barn. Protected series all exist under one roof. However, internal firewalls rope off the assets and liabilities of each protected series in separate paddocks.

Additionally, the personal assets of Series LLC members are also protected from the business liabilities of any protected series and are off limits to business creditors.

Who Uses Series LLCs?

Any business holding low-risk assets can use the Series LLC to achieve asset protection. Entrepreneurs currently use Series LLCs to protect a wide range of innovative businesses, from sophisticated investment companies to savvy ecommerce businesses.

Series LLCs have taken off in popularity amongst real estate investors. Individuals and firms managing a portfolio of properties are able to reduce liability risk by holding property titles within separate protected series. This protects each property from obligations and liabilities of any other property held within the Series LLC.

How Much Does A Delaware Series LLC Cost?

How Much Does A Delaware Series LLC Cost?