What’s the Best Way to Run Multiple Businesses Under One LLC?

If you’re a serial entrepreneur looking to maintain multiple businesses or product lines under one entity, you have several options. These include:

- Forming one LLC and creating multiple trade names for each business.

- Forming multiple LLCs managed by a Holding Company.

- Forming a Delaware Series LLC

Each of these strategies differ in cost and liability protections. Picking the best plan for you depends on the type of businesses you operate, your ultimate business goals, and your appetite for liability risk.

We explain the who, what, how, and how much for running multiple businesses.

1. MULTIPLE DBAs

What Is A DBA?

A DBA (“Doing Business As”) is a trade name that an LLC or corporation can use other than its formal corporate name. For example, Agents and Corporations, Inc. trades under the name “IncNow®.” A DBA is also referred to as a “fictitious name.”

DBAs are useful because they provide clear public notice that a particular business is actually incorporated under a different name. Entrepreneurs use DBA’s to distinguish separate businesses that are operated by one legal entity. The Limited Liability Company, or LLC, is the most popular entity type for small businesses.

How To Get A DBA.

Businesses acquire DBAs by filing a form with the Secretary of State in the company’s state of formation. DBAs also need to be notarized by an official notary in the state of formation.

The form requires general information about the business, such as:

- The corporate name,

- The business address

- The date of formation or incorporation,

- The DBA trade name,

- Nature of business,

- and the members/partners of the business and their addresses.

How Much Does A DBA Cost?

The cost of acquiring a trade name is relatively low. Filing a DBA in Delaware requires paying a filing fee of $25. There are no additional annual costs associated with maintaining a DBA.

DBA Business Protections.

A disadvantage of the multiple DBA strategy is that there is virtually no internal liability protection. When multiple businesses are operated under one LLC, the individual debts, obligations, and liabilities of each business are not segregated from one another. This means that a hostile creditor of one business could potentially gain access to the assets of another business, or the personal assets of the LLC’s members.

Who Uses DBAs?

Entrepreneurs running small scale or early stage businesses may benefit the most from the multiple DBA strategy. In this stage, the general liability risk of the business is low.

An example would be an at home entrepreneur running multiple ecommerce sites selling different types of products. Each online store can have its own trade name and exist under one LLC.

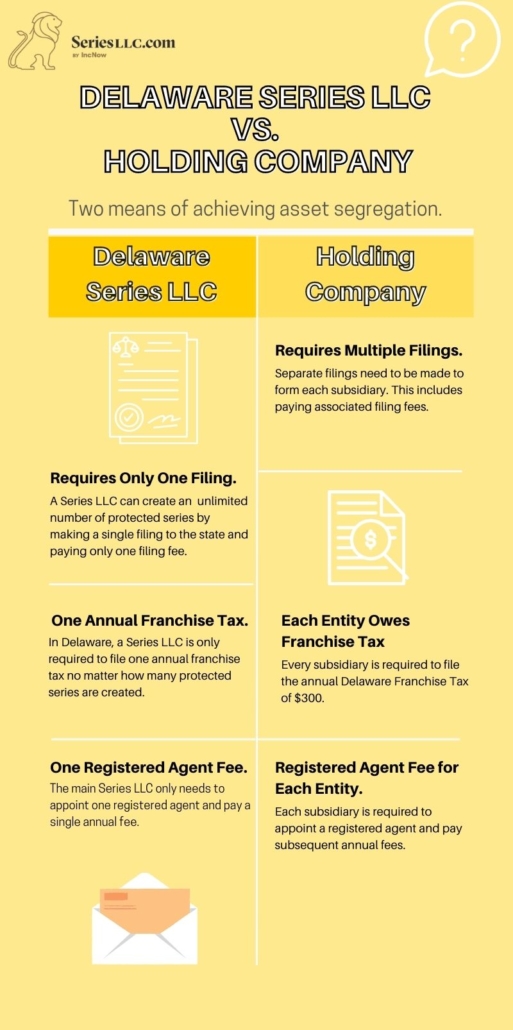

2. FORMING A HOLDING COMPANY.

What Is A Holding Company?

A holding company is an entity created for the purpose of owning and managing other individual companies. Businesses owned by a holding company are known as subsidiaries. Each subsidiary can have its own business operations while keeping its assets and liabilities separate from other related businesses.

How To Form A Holding Company.

Setting up a holding company starts with forming each business as an LLC. This is done by filing Certificates of Formation with the Secretary of State for each entity. The Operating Agreements of each subsidiary LLC will name the general holding company as the sole member.

How Much Does A Holding Company Cost?

Forming an LLC in Delaware requires a $90 filing fee. Each LLC will also have to pay an annual fee to appoint its own Registered Agent.

Additionally, Delaware requires each LLC pay the Delaware Annual Franchise Tax. This is a $300 payment due annually on June 1 each year after formation.

Holding Company Business Protections.

A holding company benefits from liability protections by operating each subsidiary as a separate LLC. The holding company is not subject to the debts, liabilities, or obligations of any subsidiary LLC. This means creditors of a subsidiary cannot access company assets of any other business. The personal assets of the LLC owners are also protected from business liabilities of any subsidiary.

Who Uses Holding Companies?

A holding company can benefit businesses holding assets with low to moderate levels of financial risk. The relatively high overhead costs of forming a holding company can be worthwhile if the structure keeps the failure of one business from sinking the entire enterprise.

Holding companies are popular amongst real estate investment firms owning and maintaining multiple properties. Traditionally, each subsidiary LLC is used to hold title to an individual property. while a parent LLC manages the properties. This allows the company to acquire separate financing for each property while shielding them from cross liability.

3. FORMING A DELAWARE SERIES LLC

What Is A Delaware Series LLC?

A Delaware Series LLC is able to create an unlimited number of protected series fenced within one entity. Each protected series can function like a mini LLC with a separate business purpose, assets and members. A protected series can be spun off into separate LLCs once the business takes off.

The Series LLC’s key feature are the internal firewalls separating each protected series. The Delaware LLC Act provides protected series with limited liability protection between one another, as well as the main LLC. Series LLC owners achieve these protections without having to make any additional filings.

How To Form A Delaware Series LLC.

Only one Certificate of Formation needs to be filed to create a Delaware Series LLC. This is one advantage that the Series LLC has over the holding company. It is important that the Certificate of Formation includes appropriate language establishing the limited liabilities of a series.

The parent LLC can then create an unlimited number of protected series without incurring any additional costs. A Delaware Series LLC creates and dissolves protected series by amending its internal Operating Agreement.

How Much Does A Delaware Series LLC Cost?

How Much Does A Delaware Series LLC Cost?

Setting up a Delaware Series LLC can be significantly more cost effective than forming a holding company with multiple subsidiaries. Forming a Series LLC in Delaware involves paying the typical state filing fee.

Delaware requires Series LLC to make only one Delaware Annual Franchise Tax payment each year after formation. Protected series are not required to pay Delaware Annual Franchise Tax. A Delaware Series LLC can create an unlimited number of protected series at no additional costs to maintain them.

Who Uses Delaware Series LLCs?

The Delaware Series LLC is the cutting edge in asset protection structures. The entity benefits entrepreneurs looking for the freedom to explore opportunities and incubate multiple business ideas.

From a small local farm owning multiple pieces of equipment, to large scale investment companies managing segregated mutual funds, the Series LLC is a dynamic structure that grows along with the business. Low startup costs and internal liability protections make the Delaware Series LLC a viable vehicle for holding a range of asset types, from simple cash assets to leveraged securities.

Series LLC Considerations

Operating a Series LLC requires diligence and organization. Delaware’s LLC laws include specific record keeping requirements that need to be met for the internal liability shields of protected series to be valid.

As easy as it may be to set up a Delaware Series LLC, it is also easy for members and managers to inadvertently impose cross liability upon themselves and their businesses. The most successful entrepreneurs use systems to manage separate records and adhere to these requirements.

Leave a Reply

Want to join the discussion?Feel free to contribute!