In 1997, Delaware passed the world’s first Series LLC law. In doing so, the Delaware LLC Act did something revolutionary. It empowered business owners to establish an unlimited number of internal asset chambers, now called “protected series” with just one state filing.

The Series LLC represents the cutting-edge in asset protection vehicles. Protected series allow business owners to separate the assets and liabilities without the need to form multiple business entities.

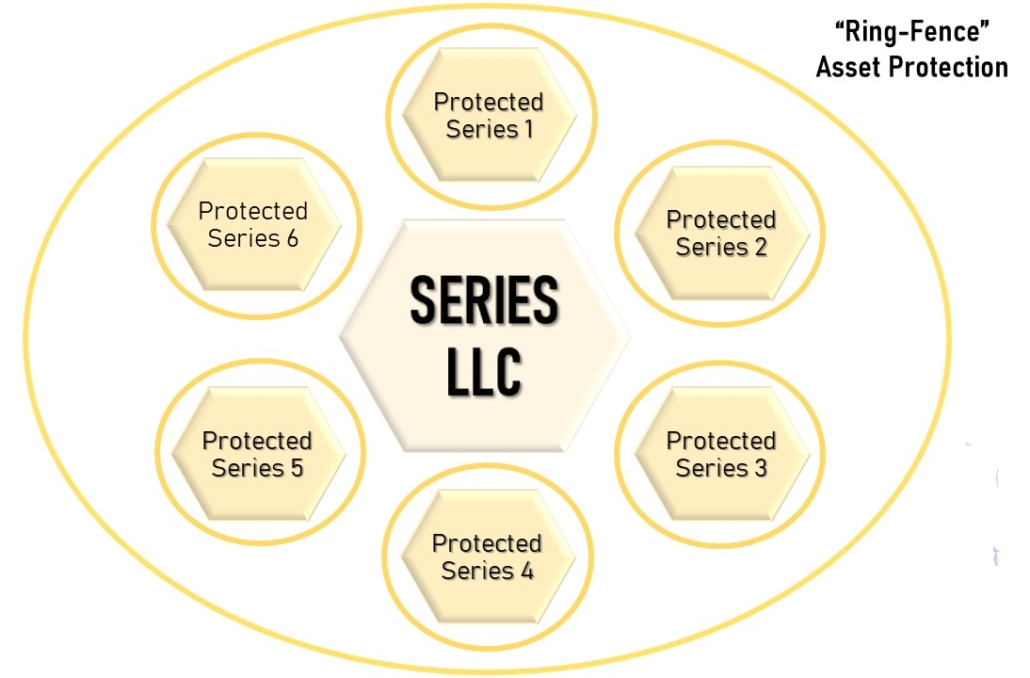

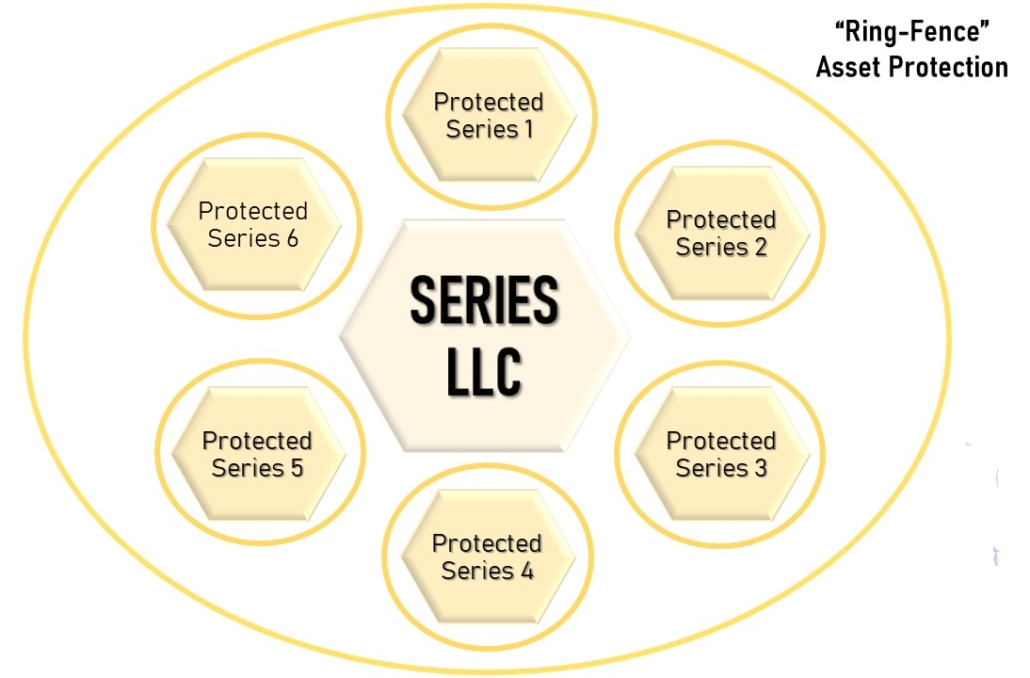

The creditors of one protected series are prevented from foreclosing on any other business assets within the Series LLC. This asset protection strategy is called “ring-fencing”. While a barn-like roof exists over the entire entity, the assets can be roped off in separate paddocks. This keeps creditors of one protected series from attaching assets of other protected series.

Who Uses Series LLCs?

Series LLCs are being used to support a wide range of innovative businesses. Oil field investments, pharmaceuticals, tax sale bidding, and captive insurance companies all use the Series LLC to achieve ironclad liability protection. Any business holding low-risk assets can use a Series LLC to achieve internal liability protection without the burden of forming multiple entities.

Serial entrepreneurs benefit from the freedom and flexibility provided by the Series LLC. Series LLCs allow multiple ideas to be incubated with just one business entity. Successful businesses in a Series LLC can even be spun off into separate LLCs.

The creditors of one protected series are prevented from foreclosing on any other business assets within the Series LLC.

Investment Companies

The Series LLC started as special interest legislation for the mutual fund industry, allowing fund managers to enjoy the protection of having multiple entities with only one filing fee. The Series LLC remains popular in the regulated finance industry. Investment companies use protected series to segregate different funds and classes of investments, isolating financial risk within a family of funds.

Real Estate Investors

Real estate investors have taken advantage of the Series LLC structure. By holding each property in a separate titleholder series, the Series LLC can protect each property from the obligations and liabilities of other properties or the LLC in general. This makes the Series LLC an attractive option for those looking to manage a portfolio of properties.

Why Is The Delaware Series LLC Best?

Since its introduction in Delaware, the Series LLC has been adopted by over one third of the United States. With new Series LLC bills being drafted all over the country, the Delaware Series LLC remains the cutting-edge. The state’s business-friendly laws make Delaware the preeminent location for your company’s legal home.

Opting into the Delaware LLC Act allows you to export the “gold standard” Delaware Series LLC law and gain access to the prestigious Delaware Court of Chancery. The benefits of forming in Delaware travel with your business. Delaware law will govern the internal affairs of your company almost wherever you operate.

Opting into the Delaware LLC Act allows you to export the “gold standard” Delaware Series LLC law.